Menu Navigation

Lists ... General Ledger ... Reconciliations

Lists ... General Ledger ... Chart of Accounts

About Reconciliations

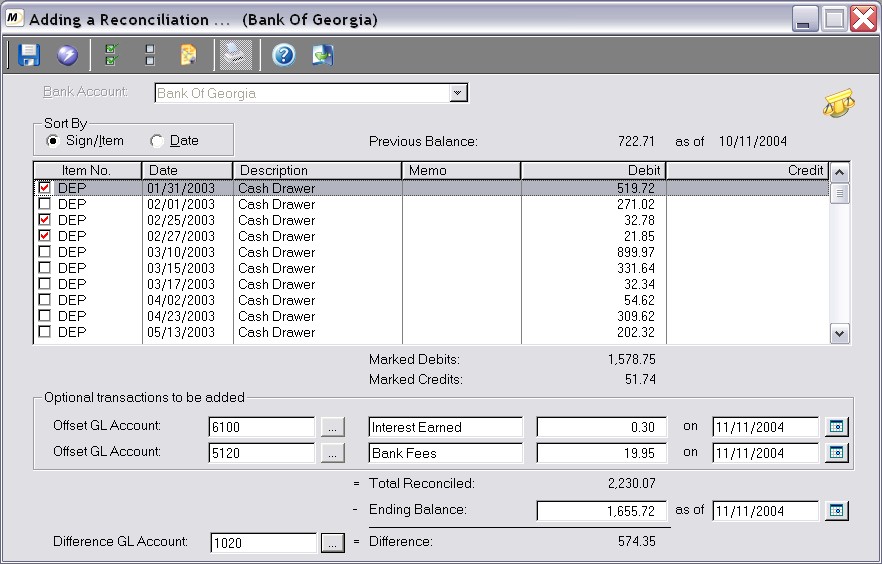

The Reconciliation screen allows you to quickly reconcile any general ledger account to an outside source. This, of course, includes the most common accounts that are reconciled: bank accounts. With this screen you can easily find and mark cleared items, enter statement charges such as interest and bank fees, print the results, and post the reconciliation to record it permanently. Past reconciliations can be easily retrieved and viewed.

In this Topic

A Detailed Look at Reconciliations

Quick Help - Reconciliations

Field by Field Help - Reconciliation screen

Q & A - Reconciliations

Related Topics

11.1 Bank Accounts

12.1 Chart of Accounts

A Detailed Look at Reconciliations

Account reconciliation involves the process of comparing a general ledger account to some statement or summarized list of transactions. The most common reconciliation is done with your bank account. With the bank statement provided by the bank, one can use the reconciliation process to locate the differences between the bank statement and what the software has recorded for deposits. Your goal in the reconciliation process is to adjust the account to bring them in agreement, or at least to understand and document the differences between the two (e.g. interest charges, deposit fees, bounced checks, statement fees, etc.).

How often reconciliations are done depends upon the business. For bank account reconciliation, you should consider monthly reconciliation.

Quick Help - Reconciliations

| 1) | Select the Chart of Accounts menu option.

|

| 2) | Highlight the desired account and click the Reconcile button.

|

| 3) | Mark reconciled transactions.

|

| 4) | Enter Optional Transactions and an Ending Balance.

|

| 5) | Click Save and Post if in balance, or Save for later posting.

|

Field by Field Help - Reconciliation screen

Buttons

Save this record

Click this button to save this reconciliation record and return to the previous window.

Save and post this record

Click this button to save this reconciliation record, post the record, and return to the previous window. This option is available only if the reconciliation is in balance.

Mark all items in the list

Click this button to check every detail item in the list.

Unmark all items in the list

Click this button to uncheck all of the detail items in the list.

View Source Document

Click this button to view the source transaction for the selected item.

Figure 12-6. Reconciliation screen

Header Fields

GL Account Number

Enter or select the general ledger account number to be reconciled. This value may be prefilled, if the reconciliation was selected from the chart of accounts. Once entered, this value cannot be changed.

Sort by

Choose whether to sort the items by item numbers within each sign (positive or negative amounts) or by date.

Previous Balance

Displays the balance prior to this reconcile and the previous date to which this balance amount is attributed. These values cannot be changed.

Detail Fields

Item No.

Displays the item number for which the transaction was posted, if any.

Date

Displays the date on which the transaction was posted.

Description

Displays a description of the transaction, if any.

Memo

Displays miscellaneous information concerning this transaction, if any.

Debit/Credit

Displays the amount debited or credited to the account.

Footer Fields

Marked Debits/Credits

Displays the total amount of debits/credits that are checked in the list to be cleared in the register.

Optional Transactions to be Added

Offset GL Account

Enter or select a GL account number to which a transaction will be posted, if an amount is entered in the field provided. This value may be prefilled based on the last value provided for reconciliation.

Offset Description

Enter a description to post for the new transaction to be created. This value may be prefilled based on the last value provided for reconciliation.

Debit/Credit Amount

Enter the amount of a transaction to be created in the reconciled account and offset to the account provided.

Date

Enter the date for the new transaction to be created. This value may be prefilled based on the last value provided for reconciliation.

Reconciliation Total Fields

Total Reconciled

Displays the ending reconciliation balance. This value is computed by the beginning balance, plus or minus checked transactions, plus or minus optional transactions added.

Ending Balance

Enter the ending balance to which the account is being reconciled (e.g. Bank Statement Balance). This value will be used for the next beginning reconciliation amount.

Ending Date

Enter the date for the ending balance provided. This value will be used as the default for the next beginning reconciliation date.

Difference GL Account

Enter or select the GL account number that will absorb the difference between the ending balance and the total reconciled.

Difference

Displays the difference between the ending balance and the total reconciled.

Q & A - Reconciliations

Q01. I've already posted a reconciliation and now I realize I made a mistake. Can I delete the posted reconciliation and start over?

A01. Once a reconciliation is posted, it can be deleted so long as it is the last reconciliation that has occurred in the list. If the reconciliation record is not the last on the list, then each of the ones that come after it must be deleted one by one, starting with the last one. Note that any journal entries or other changes that were made by the reconciliations will not be reversed upon the reconciliation's deletion.

Q02. I don't see my question here. Where else can I get information?

A02. Visit our website's Technical Support section.